Weak data in Q3 is giving way to expectations for better growth and more mobility/engagement which should help services data recover.

Economic data slowed in the third quarter, especially in the services area (the Markit Services PMI dropped from 64 in June to 55 in August). Some portion of this decline was driven by an increase in COVID cases and a decline in mobility/engagement. The data related to COVID cases is improving and the market signals from services sectors suggest that investors outlook for this part of the economy is improving.

COVID cases in the U.S. started to increase on a week-to-week basis in late June, peaked at the end of August, and declined in the month of September.

Source: WHO.

If cases continue to decline in the fourth quarter, this could lead to an increase in mobility/engagement and a rebound in services related economic activity. The market signals in leisure, hospitality, and travel sectors have been improving in the last month and may lead to better outcomes for these businesses in the coming months.

Credit card transaction companies are outperforming over the last month, led by American Express, which has a large travel and entertainment related business.

Source: Koyfin.

Hotel stocks have been outperforming the overall equity market and the general real estate market.

Source: Koyfin.

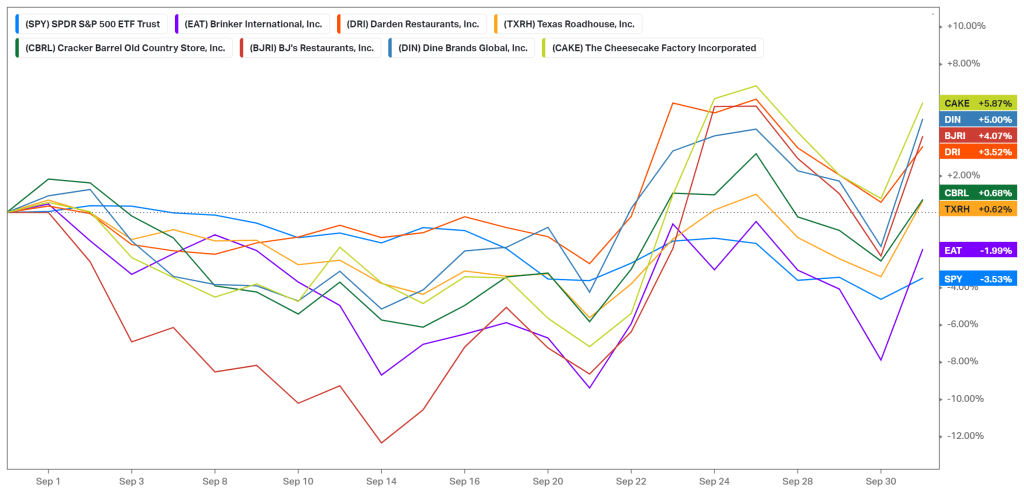

Restaurant stocks performance are improving and outperforming the overall equity market.

Source: Koyfin.

Domestic casino stocks have been rallying since the middle of August.

Source: Koyfin.

Cruise line companies have rallied over the last few weeks.

Source: Koyfin.

Airline stocks have also been strong performers since the middle of September.

Source: Koyfin.

The directional moves in COVID cases, along with the performance of in-person related equities, suggest that economic activity in coming months should likely improve, led by better services related data.

The views expressed herein are presented for informational purposes only and are not intended as a recommendation to invest in any particular asset class or security or as a promise of future performance. The information, opinions, and views contained herein are current only as of the date hereof and are subject to change at any time without prior notice.

Senior Vice President, Investment Strategy

Boyd Watterson Asset Management, LLC