One of the major debates in the economic arena is whether current inflation levels are sustainable. We thought it would be helpful to take a look at the component weights in the Consumer Price Index (CPI) calculation and the trends of the major inputs.

The largest single category of the CPI calculation is shelter and the largest component of shelter is owner’s equivalent rent. Food and energy prices are also significant components.

Source: U.S. Bureau of Labor Statistics.

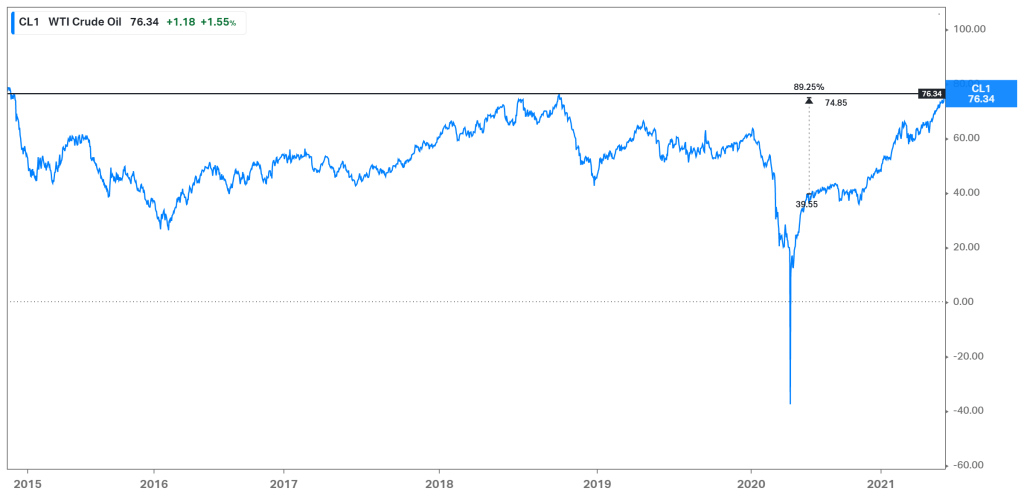

Energy prices look like they are going to continue to increase. Oil prices (West Texas Intermediate) are at the highest level since late 2014 and are up significantly from this period in 2020.

Source: Koyfin.

Food prices have declined recently but are still up significantly from this time a year ago, which will have an impact on the year-over-year (YoY) CPI calculation.

Source: Koyfin.

The shelter component of CPI had been increasing consistently at close to 3.5% YoY from 2016 until the start of the COVID-19 restrictions in the U.S. During 2020, the YoY growth continually declined and bottomed in February 2021 at 1.45%. It has since increased back to 2.2% as of May 2021.

Source: FRED.

There were a few forces impacting the shelter component of CPI that are likely going to change in the second half of 2021. One of the issues contributing to the decline has been the eviction moratorium. Over the last 12-18 months, landlords have not been able to evict tenants that are behind on their rental payments. This has prevented them from replacing these tenants with new, rent-paying tenants. As a result, rental collections declined, which impacts rental price inflation as the calculation is based on actual collected rent. These measures are being phased out, which should lead to higher rental collections and higher rental inflation.

Another likely larger contributor has been the decline in occupancy and rental rates in major metros. The rental inflation calculation is size-weighted, meaning the largest markets have the largest impact on the overall calculation. During 2020, the cities that experienced the largest YoY declines were some of the largest cities (New York, San Francisco, Los Angeles, and Boston).

Source: Hedgeye.

That trend is starting to change as rental rates in those same cities have been increasing at a 2%-3% month-over-month (MoM) rate in 2021.

Source: Hedgeye.

Source: Hedgeye.

Owners’ equivalent rent also declined in 2020. It has recently started to increase but not to the same degree as overall shelter. Owners’ equivalent rent is calculated based on how much homeowners think they could collect in rent for their home.

Source: FRED.

Owners’ equivalent rent has historically tracked home prices, as most owners base the rental rate on the monthly mortgage payment. Home prices have reached a new high and are increasing at a record pace. This will likely flow through to owners’ equivalent rent and put further upward pressure on shelter prices.

Source: Hedgeye.

While some of the price increases that have garnered headline attention like lumber, durable goods, and used car prices are not likely to continue to persist as the economy normalizes, some of the major components are likely to keep upward pressure on CPI in the second half of 2021. Consumers and corporations will need the income to absorb these higher prices, which is another input we will continue to monitor. However, our base case view is that CPI remains at an elevated level into the second half of 2021.

The views expressed herein are presented for informational purposes only and are not intended as a recommendation to invest in any particular asset class or security or as a promise of future performance. The information, opinions, and views contained herein are current only as of the date hereof and are subject to change at any time without prior notice.

Senior Vice President, Investment Strategy

Boyd Watterson Asset Management, LLC