In April, we wrote a blog post discussing what has historically caused inflation to increase and how to monitor whether the current or proposed fiscal and monetary policies would lead to higher inflation. The July Consumer Price Index (CPI) report showed that inflation has been increasing steadily since we last wrote about the topic, so we thought it would be helpful to provide an update.

In the prior post, we discussed how the price of oil and the exchange rate of the U.S. Dollar have historically been contributors to increases in CPI.

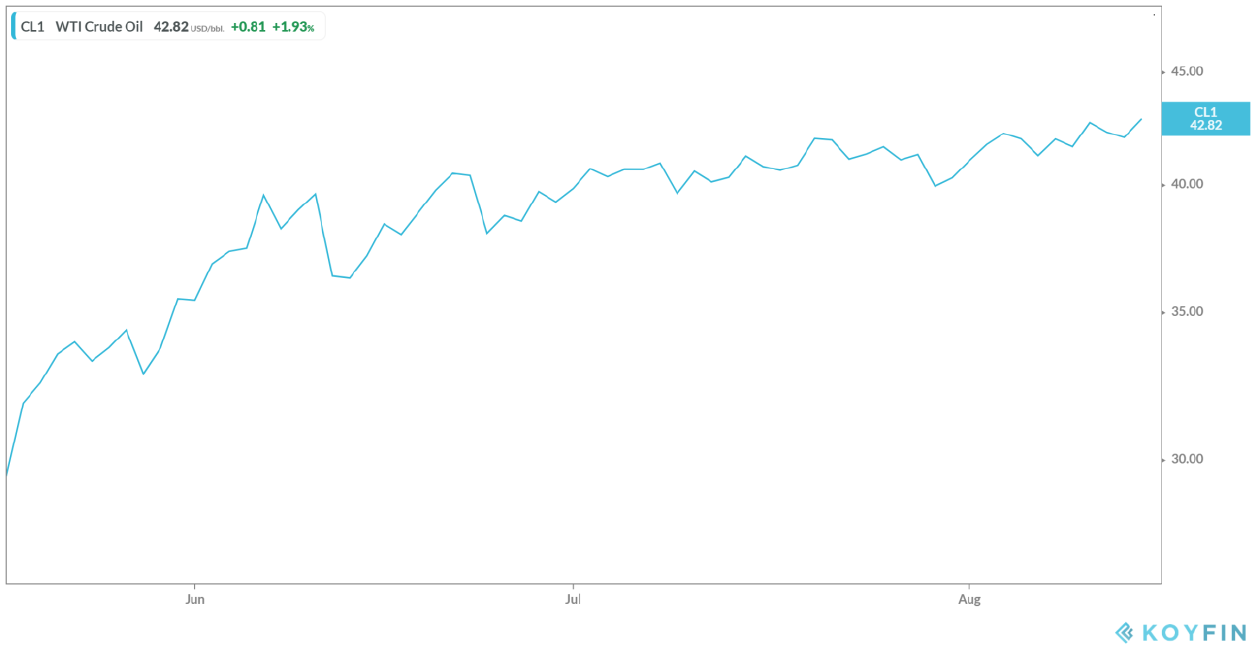

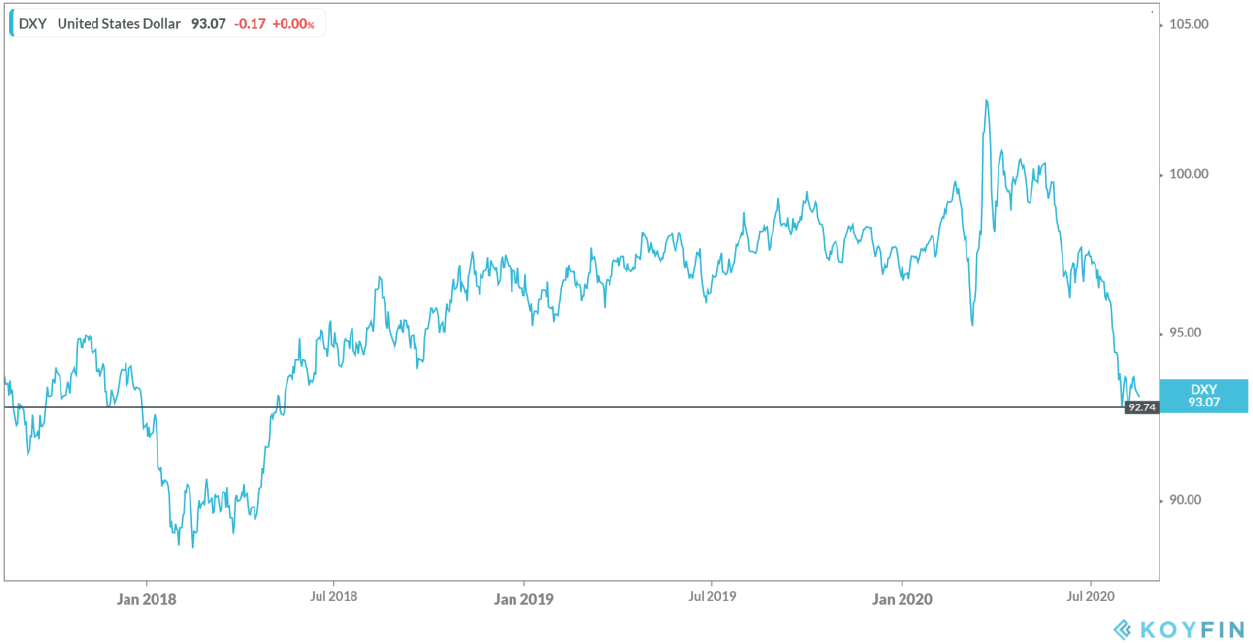

Since bottoming in the middle of April, oil prices (as measured by West Texas Intermediate or WTI) have been moving higher into the low $40 range. Other commodity prices across the spectrum (industrial metals, food, energy, and input materials) have also been increasing. Over the same period, the U.S. Dollar (as measured by the Dollar Index or DXY) has been declining and is at a two-year low.

These have been two important drivers of the increase in CPI over the last few months.

From a monetary standpoint, we mentioned the importance of watching money supply (M2) and the velocity (how much lending activity is taking place). The Federal Reserve can influence the supply of money by purchasing securities and converting those holdings into reserves, which banks can then lend. The velocity of money, the rate at which reserves/deposits get converted into loans, depends on the banks willingness to lend and the markets willingness/need to borrow.

Looking at the monetary policy side, M2 has grown at the fastest pace in the history of the data series. At the same time, velocity has declined to the lowest level in the history of the data series.

This lines up with the decline in loan growth outside of Commercial and Industrial, which, as we mentioned in the prior post, mainly consists of companies accessing lines of credit and shoring up liquidity needs.

Looking into the future, the most recent release of the Senior Loan Officer Opinion Survey (SLOOS) showed that lending conditions are tightening across all loan types, and demand is falling for everything except residential mortgages. This would suggest that credit growth and velocity are likely going to remain low. This will likely limit the impact monetary policy will have on inflation in the near term.

Turning to fiscal policy, the U.S. was running a fiscal deficit of close to 14% of GDP as of the end of July. This number will likely increase as Congress and the President are working on additions to current fiscal support efforts. The Congressional Budget Office was already projecting rising deficits before the impact of the current recession and the increase in government spending.

As we mentioned in the original post, the impact fiscal policy can have on inflation is through the impact on the exchange rate (typically an increase in the budget deficit leads to a decrease in the exchange rate). At the time that we wrote the original piece, it was unclear if the announced fiscal plans would lead to a weaker U.S. Dollar, as other countries were also announcing large fiscal policy plans. As we noted above, the U.S. Dollar has been declining and will likely continue to decline as the fiscal deficit continues to increase.

A new dynamic to fiscal policy that we discussed in the prior post is the potential for fiscal policy to shift toward sending consumers direct payments. We have seen some of this recently as many citizens received one-time payments from the federal government (regardless of their employment status) along with an increase to unemployment benefits provided by the states. The original enhanced unemployment benefits expired at the end of July and a new set of policies are currently being debated. Most of these initial payments went towards covering necessities, paying down debt, and increased savings. If these benefits stay in place after employment and income levels recover, it could lead to an increase in spending that could cause inflation levels to increase. This is a longer-term issue but warrants monitoring.

Some of the measures of inflation expectations that we mentioned last time have started to increase along with the CPI.

At the end of April, the breakeven inflation rate ranged from 0.70% for five years out to 1.4% for 30 years. Today, they range from 1.5% for five years out to 1.7% for 30 years. These are still low levels compared to the full history but are a noticeable increase from the April levels.

At the end of April, the five year-five year forward inflation rate was 1.44%. As of August 16th, it was 1.76%, which is close to the level at the end of January 2020.

At the end of March, the forward twelve-month inflation expectations based on the University of Michigan consumer survey were 2.2%. At the end of June, they had risen to 3.0%, which is the highest level since March 2015.

Some of the areas that have been contributing to the recent increase in the CPI are components that had declined significantly and are now rebounding from very low levels (clothing +1.1%, Airfare +5.4%, and hotels +1.3%). This can have an outsized impact on the percentage increase over a short period but would need to continue making improvements to influence the long-term trajectory of inflation.

Based on this review, it appears the recent increase in the CPI and other measures of inflation are being driven by a combination of the U.S. Dollar weakening, oil and commodity prices increasing, and some portions of the economy seeing a recovery from very low levels. The measures of inflation expectations have improved from the lows in April but are not signaling a significant change in inflation at this time. The lack of credit growth will likely stay in place until the economy is on firmer footing and borrowers feel more comfortable taking on new debt. This should prevent monetary policy from having much of an impact on inflation in the near term. The continued increase in fiscal policy could continue to lower the exchange rate of the U.S. Dollar. This would likely cause commodity prices to continue increasing (barring a significant decline in demand). This is the most likely source of future inflationary prices and is the area we are monitoring most closely.

The views expressed herein are presented for informational purposes only and are not intended as a recommendation to invest in any particular asset class or security or as a promise of future performance. The information, opinions, and views contained herein are current only as of the date hereof and are subject to change at any time without prior notice.

Senior Vice President, Investment Strategy

Boyd Watterson Asset Management, LLC