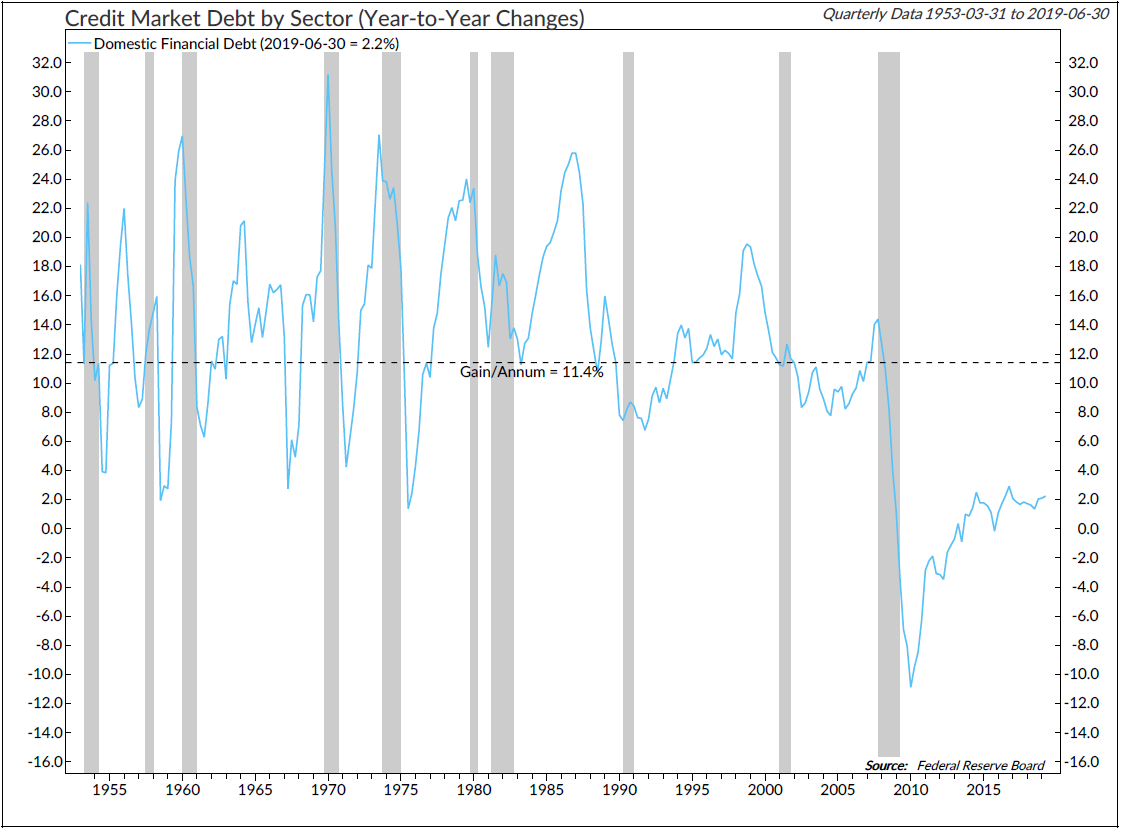

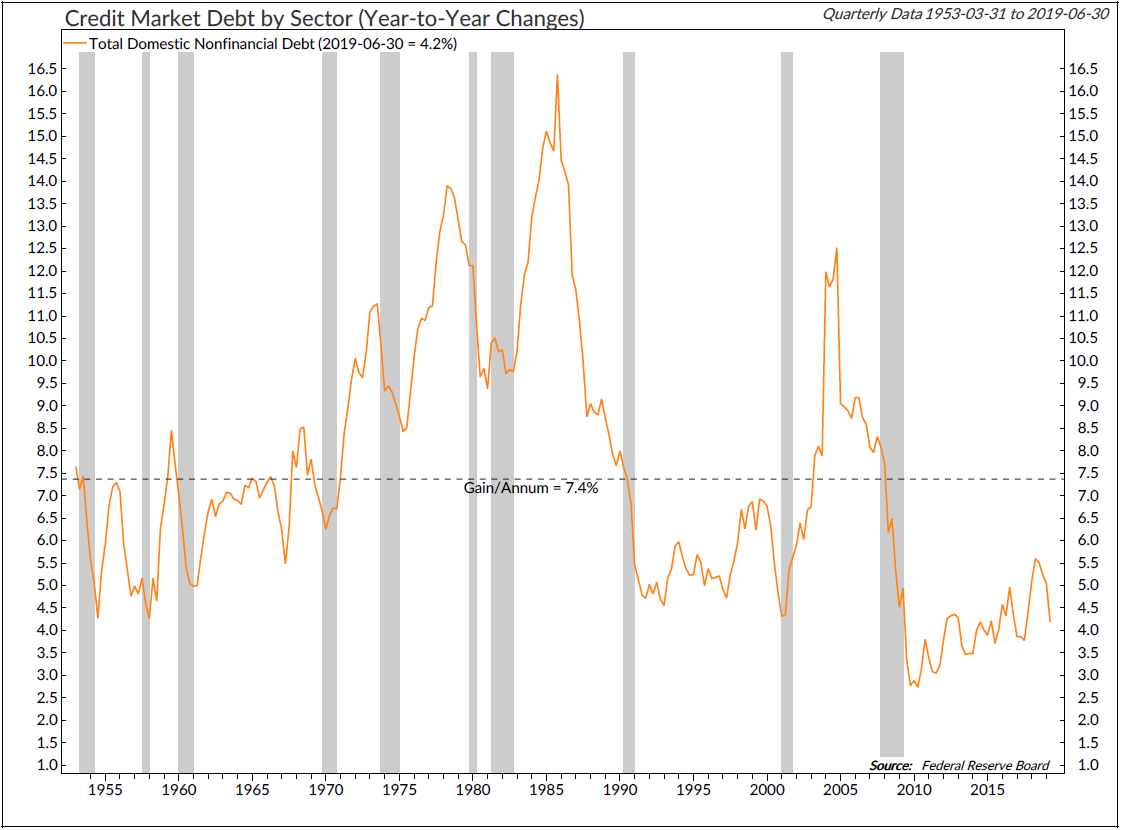

The current U.S. economic recovery is often noted for being the longest ever in terms of time duration. It is less often noted that it is also one of the weakest in terms of average annual growth rate and total output. This has occurred alongside record low interest rates in the U.S. and globally, and record levels of balance sheet expansion by central banks. There have been several reasons provided for why this expansion has been weaker than prior recovery cycles, but the decline in banking sector and overall credit growth stands to be the most in contrast to other cycles. In prior recovery periods, domestic financial debt grew at double digit annual rates. In this recovery cycle, domestic financial debt has failed to grow at an annual rate above 3%. Total domestic nonfinancial debt (consumer, corporate, and government debt) has also increased at a much slower pace than prior recoveries. In prior recovery periods, total domestic nonfinancial debt grew at high single to mid double-digit annual rates. During this recovery cycle, total domestic nonfinancial debt has not grown at a rate higher than 5.5%.

Some of the slow credit growth can be attributed to the need for private sector deleveraging (especially the consumer), after the increase in borrowing in the mid-2000s. Also, some of it can be attributed to weak end demand, domestically and globally, while another factor could be a lack of demand or demographics. It is difficult to tell if low interest rates cause credit growth to slow, which causes economic growth to slow, or if low interest rates reflect expectations of slower growth, which causes credit growth to slow. Either way, this recovery period has shown that low interest rates and an accommodative monetary policy do not by themselves lead to an increase in credit and economic growth. There is likely a transfer mechanism problem, where low interest rates do not incentivize lenders and borrowers. It would seem unlikely that more rate cuts and balance expansion would change this dynamic.

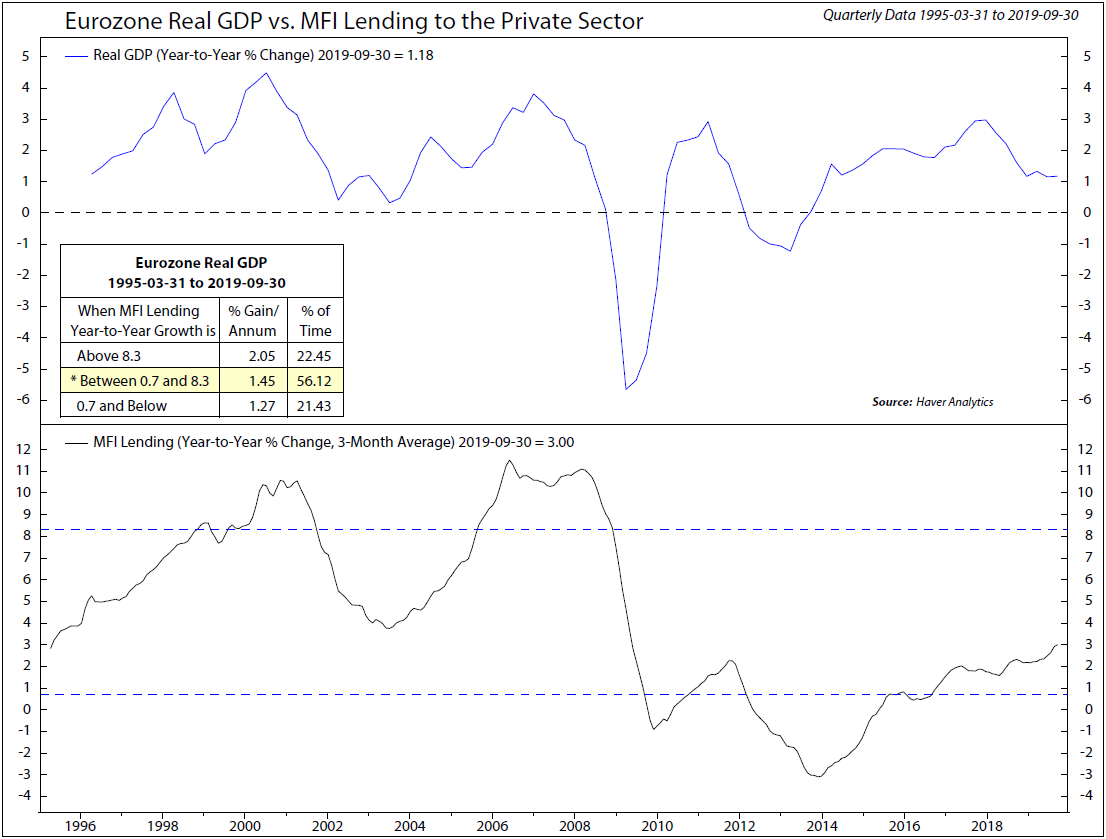

This is not just a U.S. phenomenon. The same situation has played out in Europe, where interest has been negative and balance sheet expansion has been larger.

The lack of credit growth compared to other recovery periods does not by itself signal the end to this expansion. However, it would suggest that it is likely to continue to be weaker than prior periods, and that the set up for the next recovery will start with lower rates and larger central bank balance sheets than any other period. If the current trend continues, credit growth may turn out to be even weaker in the next recovery.

The views expressed herein are presented for informational purposes only and are not intended as a recommendation to invest in any particular asset class or security or as a promise of future performance. The information, opinions, and views contained herein are current only as of the date hereof and are subject to change at any time without prior notice.

Senior Vice President, Investment Strategy

Boyd Watterson Asset Management, LLC