As an asset manager, we at Boyd Watterson are continuously monitoring several different asset classes, including the equity markets. In doing so, we separately assess high-level trends driven by the macroeconomy and sector-specific movements. We believe this allows us to constantly have our fingers on the pulse of the market as a whole and the various constituent company groups within it. We are able to make decisions regarding the favorability of end market exposure as well as the relative weights of cyclical and defensive companies held in certain strategies.

The first and most important assessment is to ensure that what we are looking at is relevant to fixed income. If it isn’t, we determine why. This brings us to the current earnings season (third quarter of 2018), which began amidst a broad global and domestic equity sell off. Markets have partially recovered at the time of this writing.

Source: FactSet

Source: FactSet

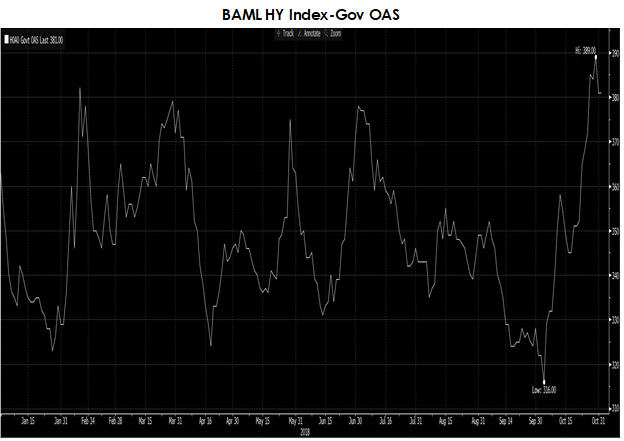

The apparent risk-off selling in the equity market caused us to ask a key question: Have the fundamentals changed? While “fundamentals” can encompass a wide range of metrics, data points both hard and soft, and so on, there are a few we will focus on for this blog post: revenue, EBITDA and earnings growth for U.S. corporations in the current quarter and forecasts for 2019. Having confidence in our view of the fundamentals and continually re-assessing that view is a staple of how we manage our portfolios. In this case, however, doing so is especially important because the moves in the equity market were not contained within it; spreads in fixed income have widened significantly during the same period. The exhibits below show spread movements YTD for indices representative of the U.S. investment grade (left) and high yield (right) universes. As you can see, the jitters evident in the equity markets have been paired with widening in fixed income.

Source: Bloomberg, Bank of America

Source: Bloomberg, Bank of America

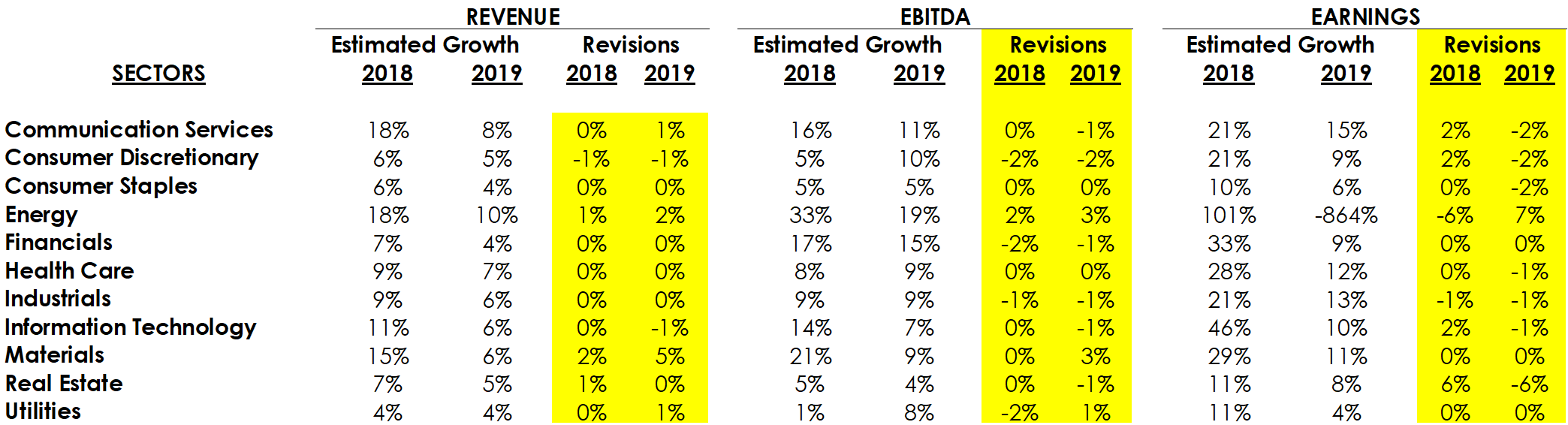

Despite all the moving pieces in equities and fixed income, company fundamentals generally remain very strong in our view. As of this writing, around 75% of constituent companies in the S&P 500 have reported. According to FactSet, revenues are up over 8%, EBITDA is up over 10% and earnings have risen nearly 25% from the prior year quarter. In addition, when looking at analyst revisions for 2019, there has been no meaningful deterioration in expected growth for corporations. The table below breaks out forecasts and revisions for 2019 by sector. It shows that despite the selling in equities, expectations for another significant year of revenue, EBITDA, and earnings growth for 2019 have not changed.

Source: FactSet

While its hard to attribute broad equity investor behavior to a single factor, we believe the core question surrounding the recent equity weakness is what to do with peaking growth rates. The stock market is anticipatory. Forward expectations dominate valuation and thus prices. Looking to 2019, nearly all sectors are forecasted to grow earnings year-over-year, but to a lesser degree. The charts below show consensus expectations for revenue growth in 2018 and 2019 by sector. The grey shaded areas show the difference in forecasted growth rates for the two years. It is clear that while growth is going to continue next year, levels are coming down.

Source: FactSet

Source: FactSet

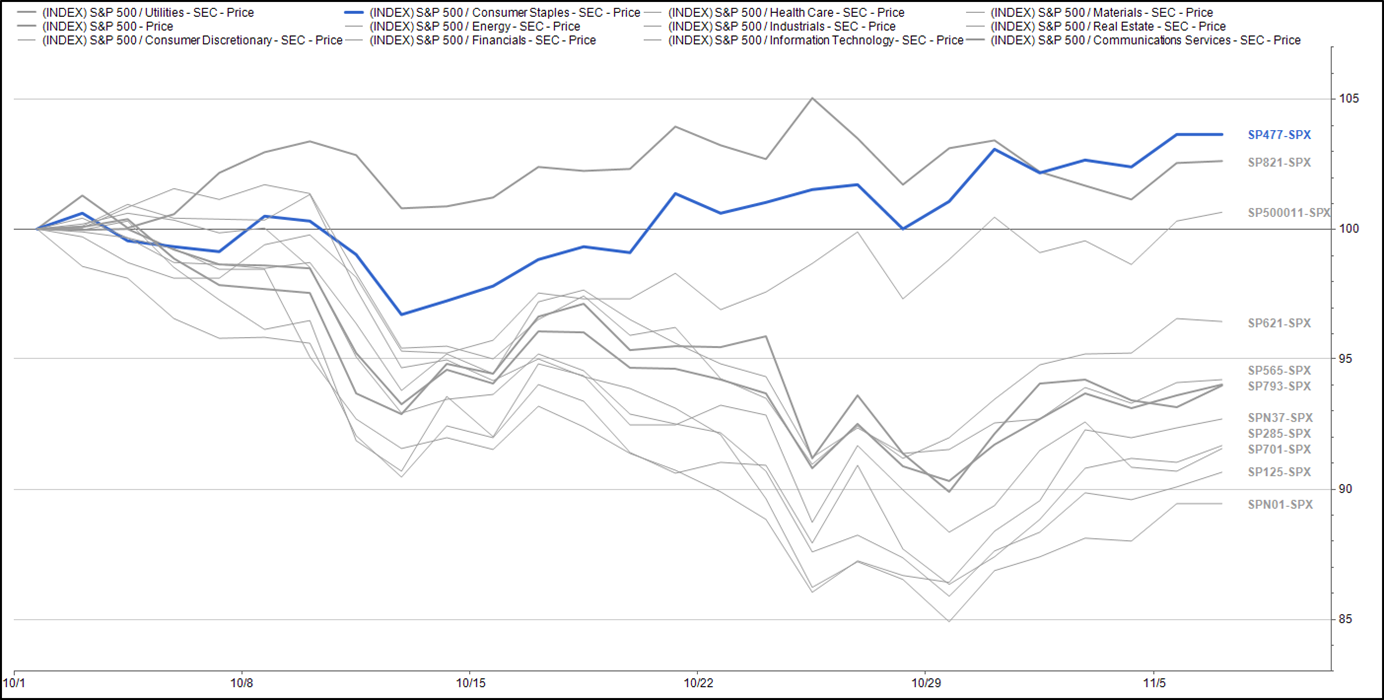

Utilities have the lowest forecasted revenue growth rate decline in 2019. It is also one of two sectors expected to grow EBITDA in 2019 at a higher rate than in 2018. This, paired with its traditional defensive characteristics, may be the two primary factors driving the sectors relative outperformance in the month of October, which is shown in the chart below.

Source: FactSet

The main takeaway is that despite market sentiment turning negative in October, especially in the equity market, we remain confident in our macro view for continued growth and contained inflation in the near term. With both the fundamentals and technicals in mind, we will remain diligent as we head into 2019.

The views expressed herein are presented for informational purposes only and are not intended as a recommendation to invest in any particular asset class or security or as a promise of future performance. The information, opinions, and views contained herein are current only as of the date hereof and are subject to change at any time without prior notice.

Senior Vice President, Investment Strategy

Boyd Watterson Asset Management, LLC