In a September update, we noted that indices, like the NASDAQ and S&P 500, were reaching new highs, but only a small number of the mega-cap stocks were contributing to the overall index performance. In late November, we noted that market breadth was improving in the U.S. and internationally. One of the drivers of that breadth expansion was the outperformance of small versus large cap stocks. One way we can continue to monitor this development is by looking at performance of market cap weighted versus equal weighted equity industry indices.

The investment firm Invesco has a series of equal weight indices that track various broad markets and industries. Since November 1st, the equally weighted S&P 500 index has outperformed the market cap weighted index by 4.5%.

Source: Koyfin.

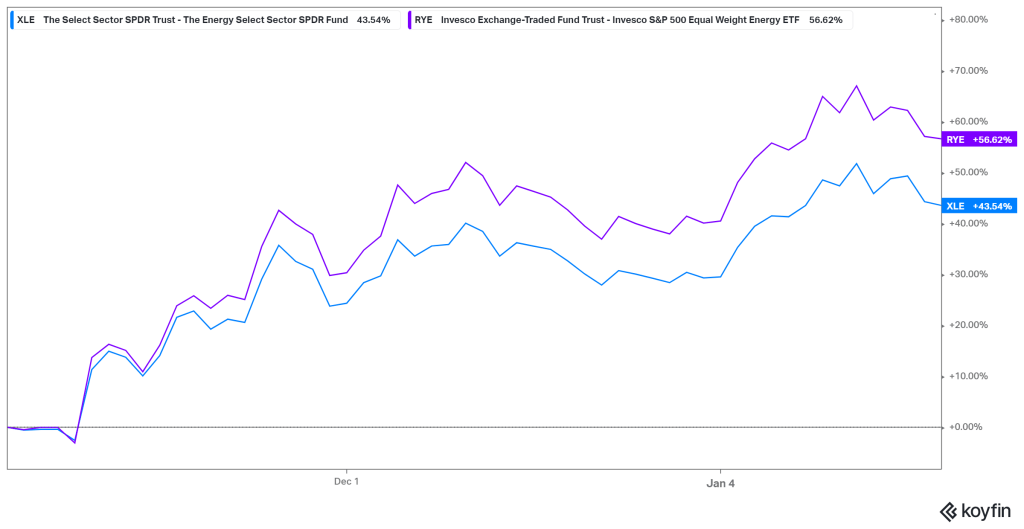

This trend can be seen most clearly in the difference of performance for some of the more concentrated industry groups like Communication Services, Technology, Discretionary, and Energy.

Source: Koyfin.

Source: Koyfin.

Source: Koyfin.

Source: Koyfin.

This has occurred at a time when some of the popular mega-cap Technology, Communications, and Consumer stocks have not made new highs, while the Russell 2000 small cap index has.

Source: Koyfin.

Source: Koyfin.

Source: Koyfin.

Source: Koyfin.

As long as the expectations for positive rates of change remain in place for economic and corporate fundamentals, market signals, like the ones mentioned above, will also likely remain in place.

The views expressed herein are presented for informational purposes only and are not intended as a recommendation to invest in any particular asset class or security or as a promise of future performance. The information, opinions, and views contained herein are current only as of the date hereof and are subject to change at any time without prior notice.

Senior Vice President, Investment Strategy

Boyd Watterson Asset Management, LLC